2019 Budget Impact on Real Estate

After the regulatory and structural reforms of RERA and GST, the real estate sector speculated high on the 2019 Budget. The interim budget has focused in a comprehensive manner on three key elements: farmers, the urban middle class and the focus on real estate. How does this budget impact the real estate industry?

We all know The Budget 2019 just got released on 1-Feb-2019 by our Interim Finance Minister, Mr. Piyush Goyal. He has added various changes to the Budget to relieve some burden in the real estate sector. The key people who benefit from this would be:

- Owners

- Real Estate

- Developers

- Home Buyers

Here is how-

PROPERTY OWNERS

- Exception from notional rent from 2nd self-occupied house- Property owners won’t have to pay tax on the 2nd property (Deemed to be self-occupied) till March-2020.

- TDS threshold increased to 2.4L- Tenants of properties need to deduct and remit TDS only for those properties with annual rent higher than Rs. 2.4 Lakhs

- SECTION 54 of income tax extended to 2 properties- This provision can be availed 2 times by the same property owner (Limit of Rs. 2Cr on capital gains is applicable)

REAL ESTATE DEVELOPERS

An exemption in the levy of tax on notional rent for unsold inventory from 1 to 2 years- The grace period availing this exemption has been extended from 12 months to 24 months.

HOME BUYERS

Incentives to buy affordable housing under Sec 80-IBA- This facility has been extended to projects which get approved before 31-Mar-2020

This budget has also placed a much needed focus on reality, supporting the government’s commitment to housing for the public and granting tax exemptions to developers. We hope these initiatives help improve the demand of end users towards real estate, providing relief to developers in the middle of current demand and slowdown in liquidity.

Let’s Analyse Union Budget 2019-20; Its Impact for Real Estate sector.

Here is what real estate gained in budget 2019:

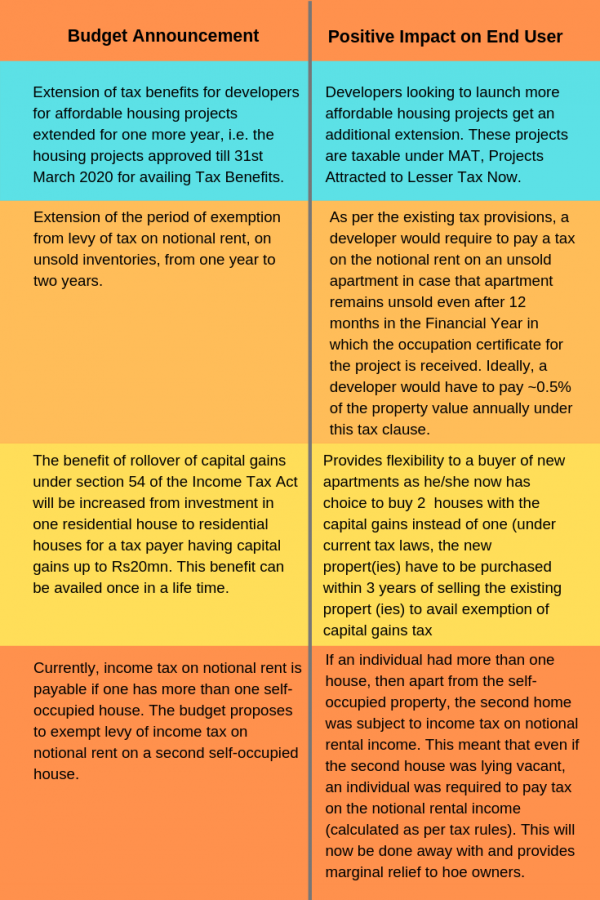

- For making more homes available under affordable housing, the benefits under Section 80-IBA of the Income Tax Act is being extended for one more year, i.e. to the housing projects approved till 31st March, 2020.

- For giving impetus to the real estate sector, FM proposed to extend the period of exemption from levy of tax on notional rent, on unsold inventories, from one year to two years, from the end of the year in which the project is completed

- Currently, income tax on notional rent is payable if one has more than one self-occupied house. Considering the difficulty of the middle class having to maintain families at two locations on account of their job, children’s education, care of parents etc, Goyal proposed to exempt levy of income tax on notional rent on a second self-occupied house.

- The benefit of rollover of capital gains under section 54 of the Income Tax Act will be increased from investment in one residential house to two residential house for a tax payer having capital gains up to Rs 2 crore. This benefit can be availed once in a life time.

- The TDS threshold for deduction of tax on rent is proposed to be increased from Rs 1,80,000 to Rs 2,40,000 for providing relief to small taxpayers.

- Individual taxpayers having taxable annual income up to Rs. 5 lakh will get full tax rebate and therefore will not be required to pay any income tax.

If you are looking to buy a home or you want to invest for future visit: www.tulsidevelopers.org